Analytical Approximation Formula for Barrier Option Prices under the Regime-Switching Model | The Journal of Derivatives

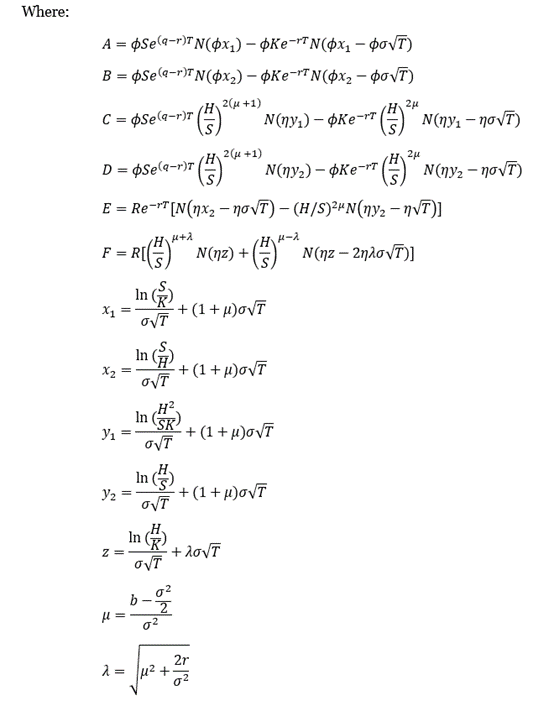

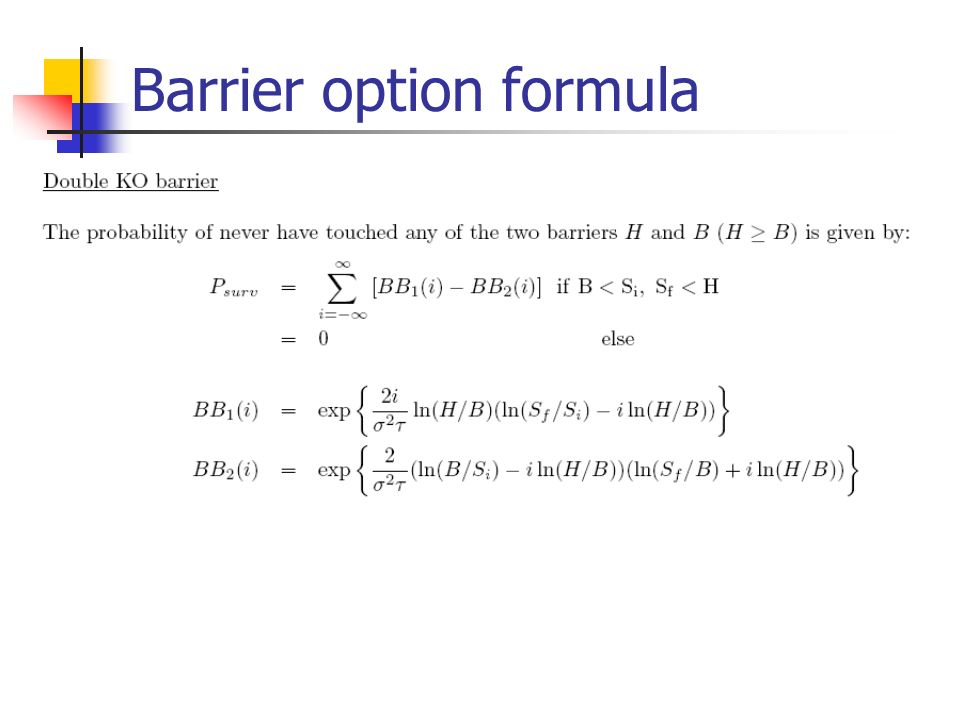

SciELO - Brasil - Use of radial basis functions for meshless numerical solutions applied to financial engineering barrier options Use of radial basis functions for meshless numerical solutions applied to financial engineering

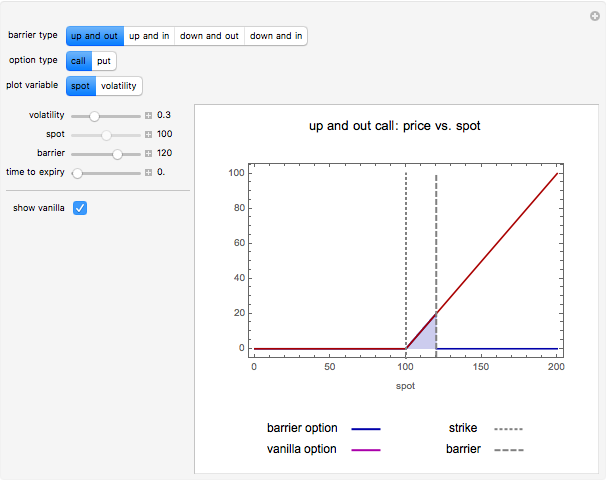

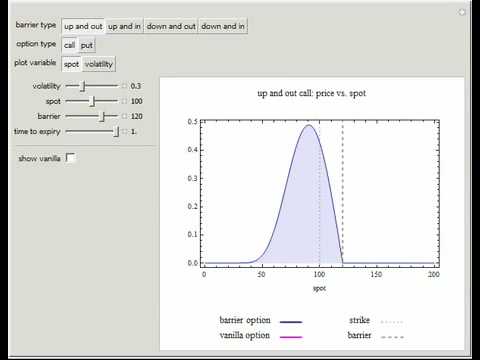

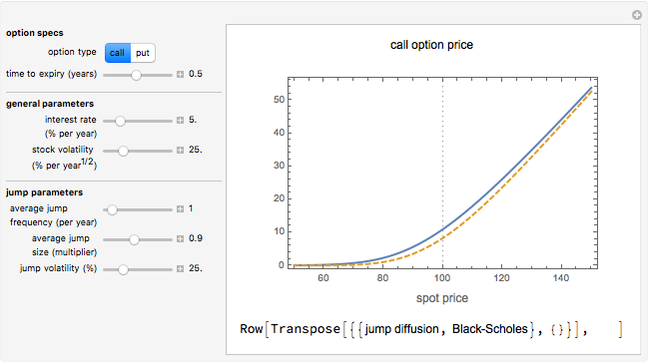

programming - Why does the closed formula result for a Barrier option price deviate so strongly from the Monte Carlo approximation? - Quantitative Finance Stack Exchange

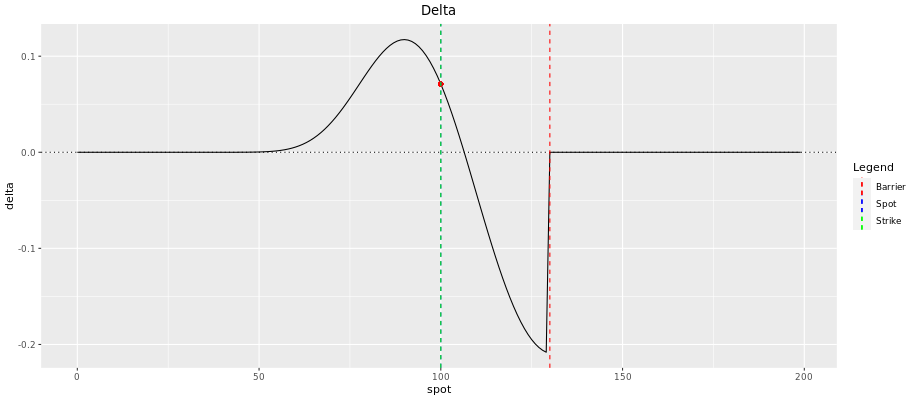

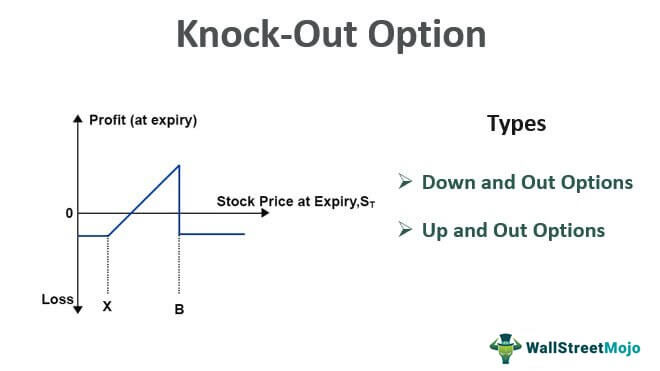

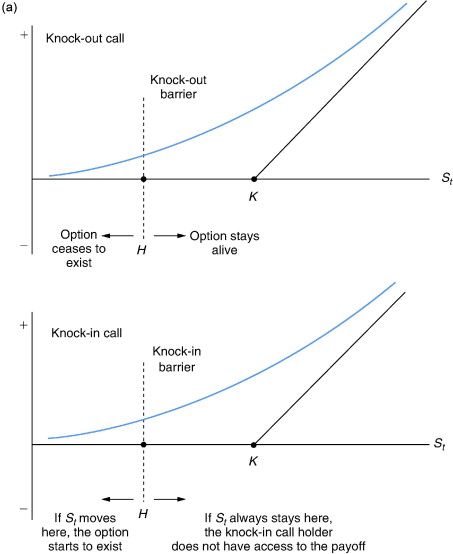

black scholes - Derivative: Delta of a Down and Out Call Option with Barrier=Debt(K) - Quantitative Finance Stack Exchange

:max_bytes(150000):strip_icc()/dotdash-INV-final-Rebate-Barrier-Option-May-2021-01-3bb9f7473625446a9bf419f8bc7ea49d.jpg)